Unique Tips About How To Avoid Social Security Taxes

Manage your other retirement income sources.

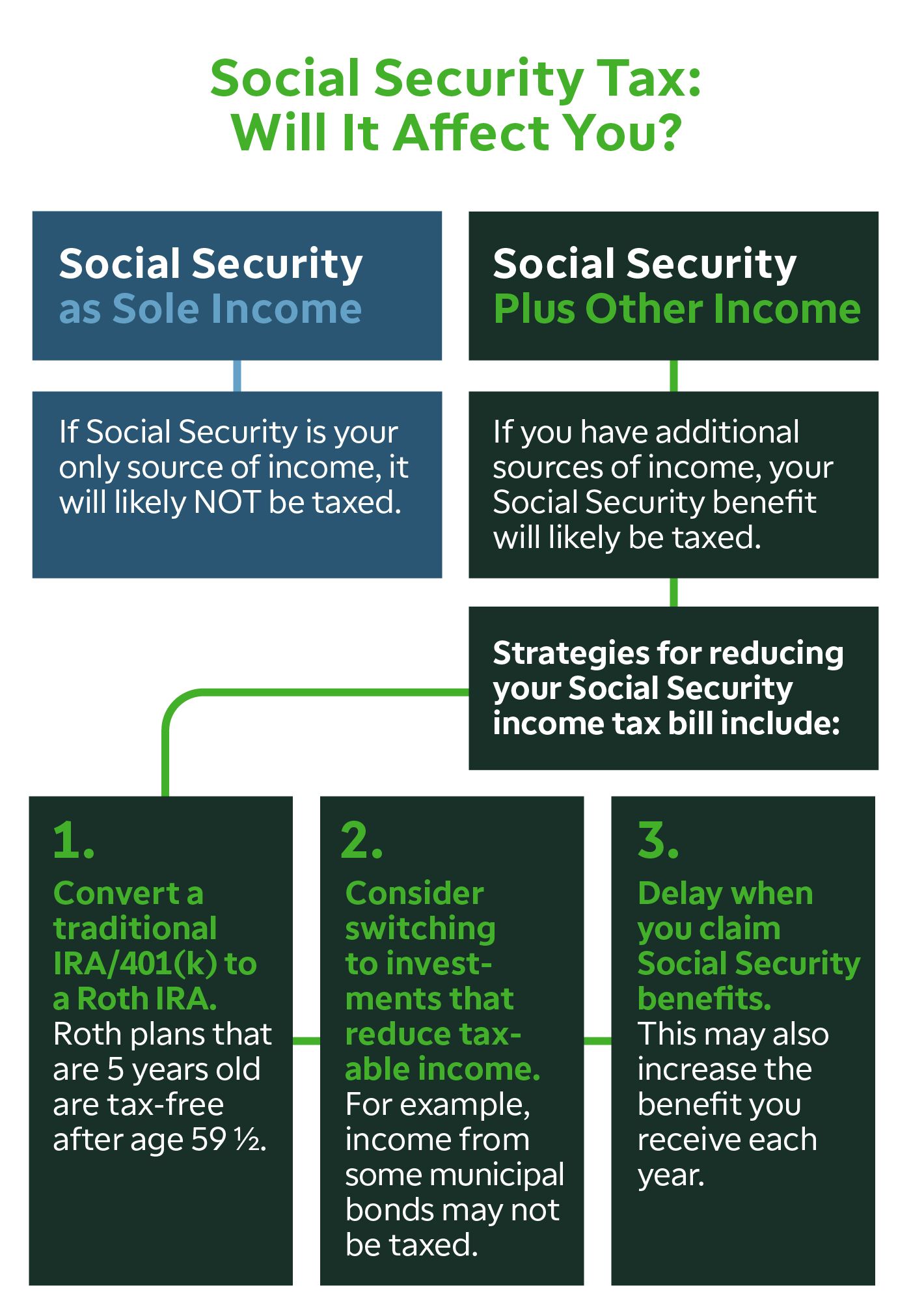

How to avoid social security taxes. All the states that don’t tax social security biden’s inflation reduction act means 87,000 new irs agents: However, the following strategies can help you avoid taxation on your social security benefits: If your provisional income is between $25,000 and $34,000 if you're single, or between $32,000 and $44,000 if you file jointly, up to 50% of your benefits may be taxable.

Wait until full retirement age to claim your payments. You may also be able to defer rmds and thus avoid paying tax on social security benefits using a qualified longevity annuity contract or qlac. Read how to avoid paying taxes on your social security from.

Here's how to fix that. You must compute your provisional income to check if you’ll be taxed on your social security benefits. The ideal way to keep your social security benefits free from income tax is to make sure your total combined income is less than the thresholds to pay tax.

Those values can be found on your 1040 tax form. Beneficiaries can check their earnings history by using their my social security account, and if they notice any discrepancies, they should report them to social security. You can put up to $135,000 in.

For example, let's assume you received the average social security benefit of. 6 ways to avoid an audit. The tax law for social security retirees talks about a certain threshold.

Elsasser also emphasized that ordinary income can increase a retiree’s capital gains tax rate. Work a bit less after. Social security benefits are subject to federal taxes no matter where you live.

For income greater than $34,000, up to 85% of benefits may be taxable. March 9, 2021, 7:30 am. One way to reduce or eliminate this is to keep most of your saving in a roth ira.

If you want to minimize tax, then you should try to keep your combined income at around $25,000. That threshold is $25,000 for a single person and $32,000 for a couple filing jointly. Taxpayers that file a joint return may have to pay income tax on up to 50% of their benefits if.

Stay below the taxable thresholds. Here's how to reduce or avoid taxes on your social security benefit: In 2020, the yearly limit is $18,240.

If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits. In certain situations, you might be getting less than you thought.

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

![Social Security Taxation [How To Avoid Paying Tax!] - Youtube](https://i.ytimg.com/vi/4scvBFeo09k/maxresdefault.jpg)