Divine Tips About How To Fight Collection Agencies

Send the original letter via certified mail.

How to fight collection agencies. In many cases, the debt collection agency will drop the lawsuit at this point because they know it may. Having a debt defense lawyer with professional expertise can help you in cases that servicers practice illegal debt. First, a debt validation letter the debt collector is required to send you, outlining the debt and your rights around disputing it;.

The program has raided refunds from the wrong people more than 600 times since 2017, forcing taxpayers to fight to get their money back. Keep a copy for yourself. Make a copy of the letter requesting the debt collector to cease contact.

100% private and fully confidential. They want you to pick up the phone; They can send you an answer to your debt validation letter and right after that, you can expect a lawsuit.

However, the creditor cannot take control of your wages unless they have. Requiring proof of the amount you owe can be one way to defend against a debt collection lawsuit. Ad a 98.7% client satisfaction rating.

Sending the request for production of documentation shows that none of those apply. That is, prove that there is a debt that you owe. Generally, if you are facing a legal challenge — and particularly if you are dealing with a lawsuit — the ideal solution is to hire an attorney to handle the situation for you.

Debt collectors will continue to contact you until a. If you send in a timely dispute, the debt collection agency. Mail a letter to the collection company and ask it to stop contacting you.

Lead attorney gary nitzkin from michigan consumer credit lawyers explains how.if yo. Here is how to fight back against them if they pursue you for a debt. There are additional things you can do to resolve debts with collectors, including picking up the phone to talk to collection attorneys and their staff.

You can, within the first 30 days, demand that the collector validate the debt for you. You have two tools you can use to dispute a debt: Don't get bullied by debtor collectors when they call;

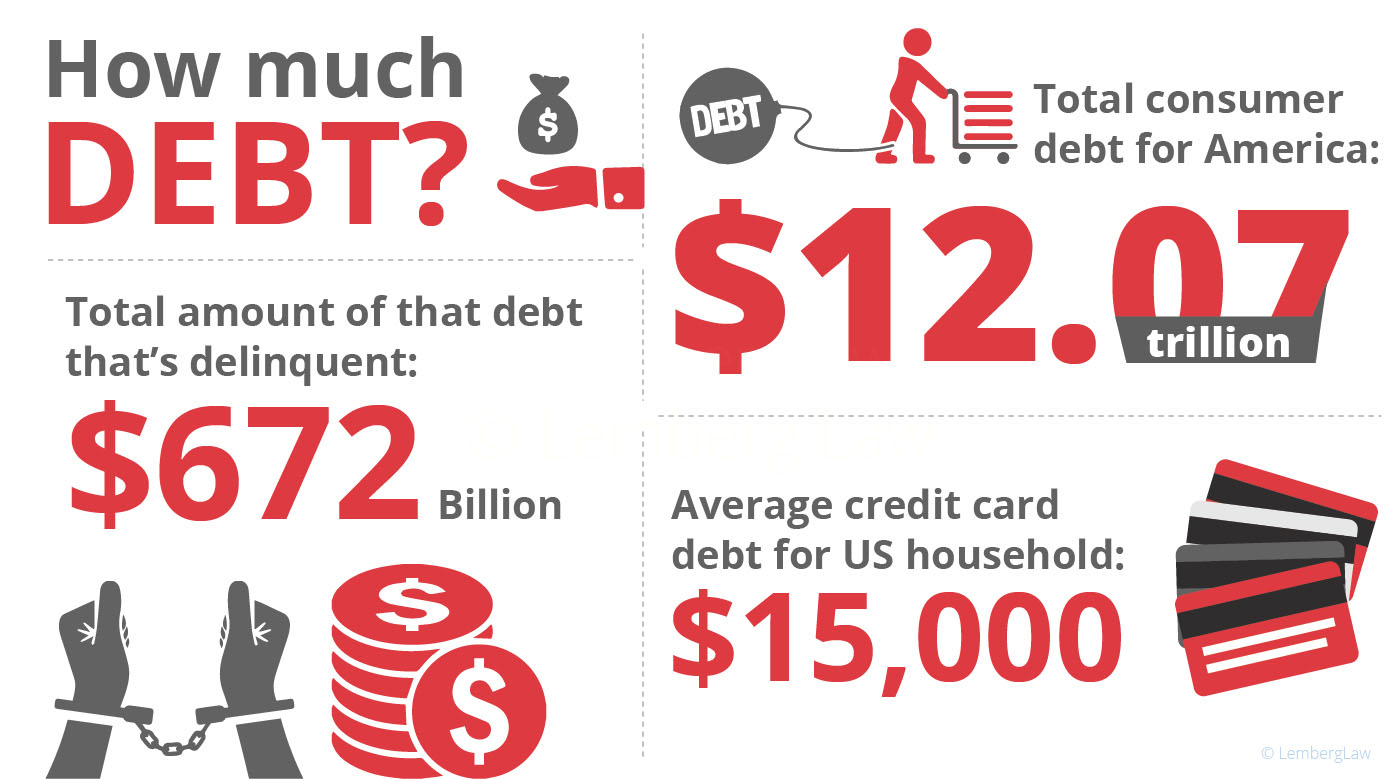

Debt collectors and collection agencies are out of control. More aggressive collection agencies will threaten to garnish employee wages as payment for a debt. For example, if a collection agency is suing you for $4,000 related to a credit.

This is a particularly aggressive move, but if you're convinced that the debt collector can't prove that. They want you to answer your collection letters. Hold debt collectors accountable for illegal behavior.